In the first half of the year, the characteristics of "differentiation" of CRO were prominent, and the growth rate of CRO was higher before clinic.

On July 2nd, CDE issued the Guiding Principles for Clinical Research and Development of Anti-tumor Drugs Oriented by Clinical Value, which triggered the CRO concept stocks in A-share and Hong Kong stock markets to plummet.

In fact, the release of the "new regulations on anticancer drugs" is a natural product of the transformation of China’s pharmaceutical industry from generic drugs to innovative drugs, from paying too much attention to the development of Me too drugs to the development of First in class or Best in class drugs, which also makes the CRO plate "differentiated". The trend has obviously accelerated.

As of August 30th, nine CRO companies including Wuxi PharmaTech, Kanglong Chenghua, Tiger Medicine, Zhaoyan New Medicine, Medici, Yaoshi Technology, Chengdu Pioneer, Ruizhi Medicine and Boji Medicine have disclosed the results of the interim report in 2021. This paper will select the key companies for comprehensive analysis.

Pre-clinical CRO or CXO faucet increased even more.

On the whole, as of the close of August 27th, 2021, there were only three CRO companies with a total market value of more than 100 billion yuan: WuXi PharmaTech (383.7 billion yuan), Kanglong Huacheng (154 billion yuan) and Tiger Pharmaceuticals (119.1 billion yuan), and two companies with a total market value of less than 10 billion yuan: Ruizhi Pharmaceuticals (6.924 billion yuan) and BoJi Pharmaceuticals (2.822 billion yuan).

1. Tiger Medicine: The total market value decreased the most, and the increase was at the bottom.

Tiger Medicine, a leading clinical trial research service, had a total market value of 145.267 billion yuan at the beginning of the year (January 4, 2021), and the latest total market value was 119.1 billion yuan at the close of August 27, and the total market value has dropped by 26.167 billion yuan since the beginning of the year. The stock price dropped by 15.39%, which was the biggest drop among the three hundred billion CRO leaders, and ranked the bottom in the CRO industry.

In terms of performance, Tiger Pharmaceuticals achieved a total revenue of 2.056 billion yuan in the first half of the year, a year-on-year increase of 41.62%; The net profit was 1.255 billion yuan, a year-on-year increase of 25.65%; Deducting non-net profit was 543 million yuan, up 79.1% year-on-year. In the second quarter, the net profit was 799 million yuan, a year-on-year increase of 7.48%.

In terms of main business, the company’s clinical trial technical services, clinical trial related services and laboratory services achieved revenues of 1.034 billion and 1.016 billion respectively in the first half of the year, up by 45.36% and 38.43% year-on-year.

At the same time, in terms of non-main business income, the company realized investment income of 113 million yuan in the first half of the year, accounting for 6.65% of the total profit; The gains and losses from changes in fair value reached 906 million yuan, accounting for 53.53% of the total profits, which were mainly due to the investment income confirmed during the holding period and disposal of other non-current financial assets of the company during the reporting period.

2. Kanglong Chenghua: The total market value increased the most.

The total market value of Kanglong Huacheng at the beginning of the year was 94.919 billion yuan. As of the close of August 27th, the latest total market value reached 154 billion yuan, an increase of 59.081 billion yuan, which is almost equivalent to the market value of Zhaoyan New Medicine (53.86 billion yuan) and Wise Medicine (6.924 billion yuan).

Secondly, the total market value of Wuxi PharmaTech and Medici increased by 50.22 billion yuan and 31.4 billion yuan respectively compared with the beginning of the year, ranking second and third.

3. Medici: The stock price and total market value increased the most.

The share price of Medici rose as high as 323.05% compared with the beginning of the year, and the total market value also increased by 31.4 billion yuan, with an increase rate of 324.42%, ranking first.

The financial report shows that Medeci achieved total revenue of 485 million yuan in the first half of the year, an increase of 86.26% year-on-year; The net profit of returning to the mother was 113 million yuan, a year-on-year increase of 142.29%, ranking among the top in the industry, and its performance was quite beautiful.

In the first half of 2021, thanks to the sustained growth of domestic and international drug R&D boom, the business performance of Medeci achieved steady growth. The two main businesses, drug discovery, pharmaceutical research and preclinical research, achieved revenues of 260 million and 225 million, respectively, which increased by 78.59% and 95.38% year-on-year.

To sum up, Wuxi PharmaTech and Kanglong Chenghua, which realize the whole industrial chain of CXO, have gained 15.06% and 62.24% respectively year-to-date by virtue of their high competitive barriers.

At the same time, the growth rate of preclinical CRO business is also quite high. The molecular block leader Yaoshi Technology has increased by 56.96% year-to-date, the drug safety evaluation leader Zhaoyan new drug has increased by 93.39%, and the increase rate of Medici is as high as 323.05%.

This means that the CRO plate has shown an obvious performance "differentiation" market.

Performance differentiation is obvious: WuXi PharmaTech has the highest revenue scale and Medici has the fastest growth rate.

On the whole, the growth rate of total revenue and net profit of these nine CRO companies both achieved positive growth in the first half of 2021, with a total revenue and net profit of 18.639 billion yuan and 5.183 billion yuan respectively.

1. WuXi PharmaTech: The scale of total revenue and net profit income is the highest.

In the first half of 2021, Wuxi PharmaTech achieved a total revenue of 10.537 billion yuan, a year-on-year increase of 45.71%; The net profit was 2.675 billion yuan, a year-on-year increase of 55.79%.

WuXi PharmaTech’s main business is divided into laboratory services in China, contract production R&D services (CDMO), clinical research and other CRO services, and laboratory services in the United States. In the first half of the year, the revenue was 5.487 billion yuan, 3.599 billion yuan, 783 million yuan and 659 million yuan respectively.

Among them, the negative impact of clinical research and other CRO services caused by the domestic COVID-19 epidemic has been basically removed, showing a substantial increase compared with the comparable period: the revenue in the first half of the year was 783 million yuan, up 56.51% year-on-year.

During the reporting period, Wuxi PharmaTech Clinical Trial Services (CDS) team provided clinical trial development services for more than 170 projects in China and the United States. At the same time, it helped customers to complete three new drug listing registrations and five clinical research applications. Help five ADC projects achieve important milestones and a number of clinical research and development for COVID-19 products.

2. Medici: The growth rate of total revenue and net profit is the highest.

Although Yaoshi Technology achieved a net profit of 381 million yuan in the first half of the year, the year-on-year growth rate of net profit was as high as 336.5%. However, after deducting the non-recurring profit and loss of 236 million yuan, the non-net profit was 145 million yuan, an increase of 77.16%.

Among the non-recurring gains and losses of 236 million yuan of Yaoshi Technology, the highest proportion is that Yaoshi Technology completed the acquisition of Zhejiang Huishi, a CDMO company, in April 2021, and the gains generated by re-measuring the equity held before the purchase date at fair value amounted to 222 million yuan.

Relatively speaking, the profit quality of Medici is higher: the total revenue in the first half of the year was 485 million yuan, up 86.26% year-on-year; The net profit returned to the mother was 113 million yuan, a year-on-year increase of 142.29%, and the non-net profit was 110 million yuan, a substantial increase of 150.14%.

Composition of revenue in Medici

Source: 2021 Mid-year Report

During the reporting period, the number of new orders signed by Medeci maintained a good growth trend, with the amount of new orders reaching 1.026 billion yuan, with a growth rate of 93.64%. Sufficient orders laid a good foundation for future development. The company has provided drug research and development services to more than 1,100 customers at home and abroad, and added 161 customers during the reporting period.

During the reporting period, drug discovery and pharmaceutical research services signed 476 million yuan, an increase of 85.65%. Among them, 321 million yuan was newly signed for drug discovery, up 106.78% year-on-year; The number of newly signed orders for pharmaceutical research was 155 million yuan, a year-on-year increase of 53.29%.

3. Wise Medicine: the net profit and its growth rate are the lowest.

Ruizhi Medicine is mainly engaged in the research and development, production and sales of CRO and CMO, series of prebiotic products such as fructooligosaccharides and galactooligosaccharides, and micro-ecological medical services.

In the first half of 2021, Ruizhi Pharmaceutical achieved a total revenue of 845 million yuan, a year-on-year increase of 26.14%, but its net profit was only 5.138 million yuan, a year-on-year decrease of 87.43%. Deducting non-net profit was a loss of 1,007,800 yuan, down 103.26% year-on-year.

During the reporting period, the company’s pharmaceutical R&D and production outsourcing services (CRO/CDMO) sector achieved operating income of 684 million yuan, accounting for 81% of the company’s total revenue. Among them, preclinical drug R&D outsourcing service (preclinical CRO), as an important part of pharmaceutical R&D and production outsourcing service (CRO/CDMO), achieved an operating income of 578 million yuan during the reporting period, accounting for 84% of CRO/CDMO.

To sum up, leading CRO enterprises that realize the whole industrial chain of CXO, establish platform advantages, or specialize in clinical research business have higher income scale and stable performance growth rate.

However, in preclinical research such as drug safety evaluation, molecular building blocks, drug discovery and pharmaceutical research services, the CRO leader with competitive advantage has been established. Although the income scale is low, the performance growth rate is very fast.

WuXi PharmaTech invested the most in R&D, and Chengdu Pioneer was the most willing to invest in R&D.

The key to WuXi PharmaTech’s brilliant performance lies in its strong R&D strength and strong team support.

Specifically, WuXi PharmaTech’s R&D investment in the first half of 2021 reached 404 million yuan, an increase of 21.29% over the same period of last year, mainly due to the company’s commitment to platform empowerment, including enzyme catalysis, flow chemistry, etc., and focused on a series of new capacity-building R&D activities such as AI reverse synthesis and resource sequencing algorithm development..

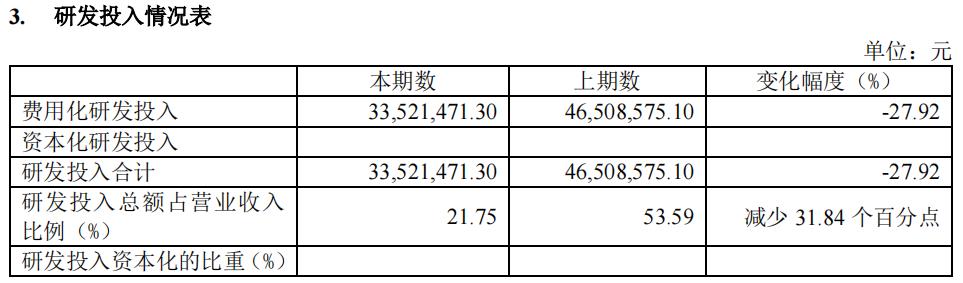

However, Chengdu Pioneer is the most willing to invest in R&D. In the first half of the year, it invested 33.5215 million yuan in R&D. Although it decreased by 27.92% compared with last year, the R&D expense ratio (the ratio of R&D investment to operating income) is still as high as 21.43%. At the same time, the gross profit margin of sales is as high as 52.2%.

Chengdu Pioneer’s main business is to provide research and development services in the early drug discovery stage and transfer of new drug research and development projects. The product types include DEL screening services, DEL library customization services, chemical synthesis services, and new drug research and development project transfer.

During the reporting period, Chengdu Pioneer increased the introduction of R&D personnel in related fields of core technology platforms, enriched the R&D team, and maintained the company’s R&D innovation capability. The number of R&D personnel increased to 379, accounting for 82.93% of the total number of the company. At the same time, by increasing R&D investment and expanding business cooperation, we will continue to strengthen the construction of its core technology platform -DNA coding compound library, and optimize the trillion-dollar DEL new molecular entity library.

Chengdu Pilot R&D Investment Table

Source: 2021 Mid-year Report

In addition, Boji Medicine (9.92%), Yaoshi Technology (8.21%) and Medici (7.01%) have high R&D expense rates. In the first half of the year, the R&D personnel of Wuxi PharmaTech and Medici also accounted for 82.88% and 85.48% of the total number of the company respectively.

Among them, Medici’s R&D investment in the first half of the year increased by 77.04% compared with last year, mainly due to the company’s continuous increase in investment in independent R&D projects in order to improve its R&D service capabilities and business undertaking capabilities and enhance its competitive advantage.

During the reporting period, the company expanded the construction scale and application of protein Degradation Technology (PROTAC) platform; Establish a research and development platform for small molecule drug discovery and a safety evaluation system for scale-up production process that meets the requirements of international norms; Continue to promote the improvement of new biotechnological drugs (including stem cells, CAR-T cells, ADC drugs, oncolytic viruses and other gene therapy products, as well as mRNA vaccines, etc.), and the construction of a technical platform for pre-clinical effectiveness and safety evaluation.

Among many CRO companies, employees of Yaoshi Technology can make the most money. In the first half of this year, the per capita income and per capita profit were as high as 454,000 yuan/person and 278,000 yuan/person respectively, mainly because the company actively expanded the market, increased sales orders and enhanced delivery capacity.

During the reporting period, in addition to the derivative growth of mid-and late-stage projects, Pharmaceutical Stone Technology accumulated a large number of early projects, forming a sustainable growth project pipeline. Among the projects undertaken by Pharmaceutical Stone Technology in the first half of the year, more than 320 were in pre-clinical stage to clinical stage II, and 29 were in clinical stage III to commercialization stage; In addition to the above projects, there are more than 350 projects above the kilogram level.

At the same time, Yaoshi Technology continues to expand its service customer base, especially small and medium-sized biotech companies. During the reporting period, the number of customers who formed orders was 722, a year-on-year increase of 5%; There were 105 terminal customers (including only domestic and foreign pharmaceutical companies and small and medium-sized innovative drug companies) above the kilogram level, with a year-on-year increase of 25%; There were 27 customers with sales of more than 5 million, a year-on-year increase of 42%.

To sum up, in the first half of 2021, due to the influence of policies and significant differences in performance, CRO companies showed obvious "differentiation" in the capital market.

Wuxi pharmatech and Kanglong Chenghua occupy the platform advantages of the whole industrial chain of CXO, and maintain the leading position of the strong. Pharmaceutical stone technology, Zhaoyan new drugs and Medicines, which have been engaged in preclinical research business for many years and established competitive advantages, are also favored by the capital market.

On the whole, under the background of accelerating the transformation from generic drugs to innovative drugs in China, high-quality CRO companies will still maintain a high degree of prosperity for a long time and have long-term investment value.

Source: Yaozhi. com

Author: Zongge 2025

Typesetting: Janessa

Editor: Adam